Hard cash loans have benefits which make them appealing for sure takes advantage of and certain varieties of borrowers. Permit’s Look into the kinds of borrowers who consider out hard cash loans as well as widespread reasons why.

Visio Lending’s interest charges are eye-catching. The business does not qualify borrowers dependant on private cash flow or credit rating score, so significantly less-than-best credit rating is just not a barrier to entry for housing investing.

Insight into this ratio, together with a sturdy evaluation of fairness, equips borrowers with a practical viewpoint to the feasibility of a hard money loan, making sure they have got enough collateral to meet the lender's terms and safeguarding towards over-leverage.

In traditional financing, a borrower's creditworthiness and fiscal historical past are preliminary components, but in hard money lending, the collateral—the tangible asset—is key. The home place forth as a hedge in opposition to the loan must have sufficient equity to entice revenue lenders, generally necessitating the establishment of the escrow account to deal with the money transactions securely.

Nonetheless, Every lender also excels in several locations. So, regardless of whether A fast closing timeline is actually a prime precedence or superb customer care is a must, you’ll possible discover a hard money lender below to fit your wants.

Design loans supply financing for the development or renovation of residential or professional projects.

Finding the very best hard money lender may perhaps feel frustrating in the event you’re not sure exactly where to start out. Understanding terms, charges, and charges, in addition to your undertaking and economic goals, will speed up your capacity to move ahead with an expenditure.

Sherman Bridge Lending offers perfectly superior hard income loans with fair costs and turnaround instances. There’s lots we like over it, and we’d Fortunately suggest it to quite a few borrowers.

The forthcoming material will offer a concentrated take a look at leveraging hard funds loans for every of such strategic initiatives, delineating their sensible Added benefits and issues.

Lima Just one presents pretty minimal-interest premiums as compared to most hard income lenders on this list. Therefore if preserving on curiosity matters for you but Groundfloor doesn’t operate, Lima One gives an excellent alternative.

Patch Lending is undoubtedly an uncommon hybrid of lending and crowdfunding. Patch Lending to begin with funds your hard funds loan, but then it invitations buyers to crowdfund the loan quantity in return for desire. It’s an thrilling design, and borrowers appear to be to love Patch Lending General.

That said, it’s not The most cost effective or speediest lender on the market. As well as, we’ve viewed some grumbling from dissatisfied buyers, that makes us be concerned about Patch Lending's long run. That shouldn’t automatically hold you from borrowing, nevertheless it does maintain Patch Lending from remaining considered one of our best picks.

Given that hard revenue loans have significantly less stringent prerequisites, they’re generally much easier to get for borrowers with a lot less-than-stellar credit history, a individual bankruptcy hard loan lenders on their document or other negative objects on their own credit rating report. Hard revenue loans can also be often employed by homeowners trying to circumvent foreclosure.

You've got likely read the indicating it's going to take revenue to earn cash, but often you wish it to acquire just a little significantly less cash to start. The good thing is, Household Funds Companions understands.

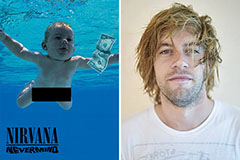

Spencer Elden Then & Now!

Spencer Elden Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now!